CLIENTS AND PARTNERS

How We Do It

Where global coverage meets local precision.

companies covered from 2016 onwards

assets classified into 105 types

methodologies powering granular insights

with AI and machine learning

from single assets to entire portfolios

capabilities for complex and private entities

with operational, upstream and downstream data

via data feeds, API and user-friendly web apps

Our Solutions

Impact Intelligence

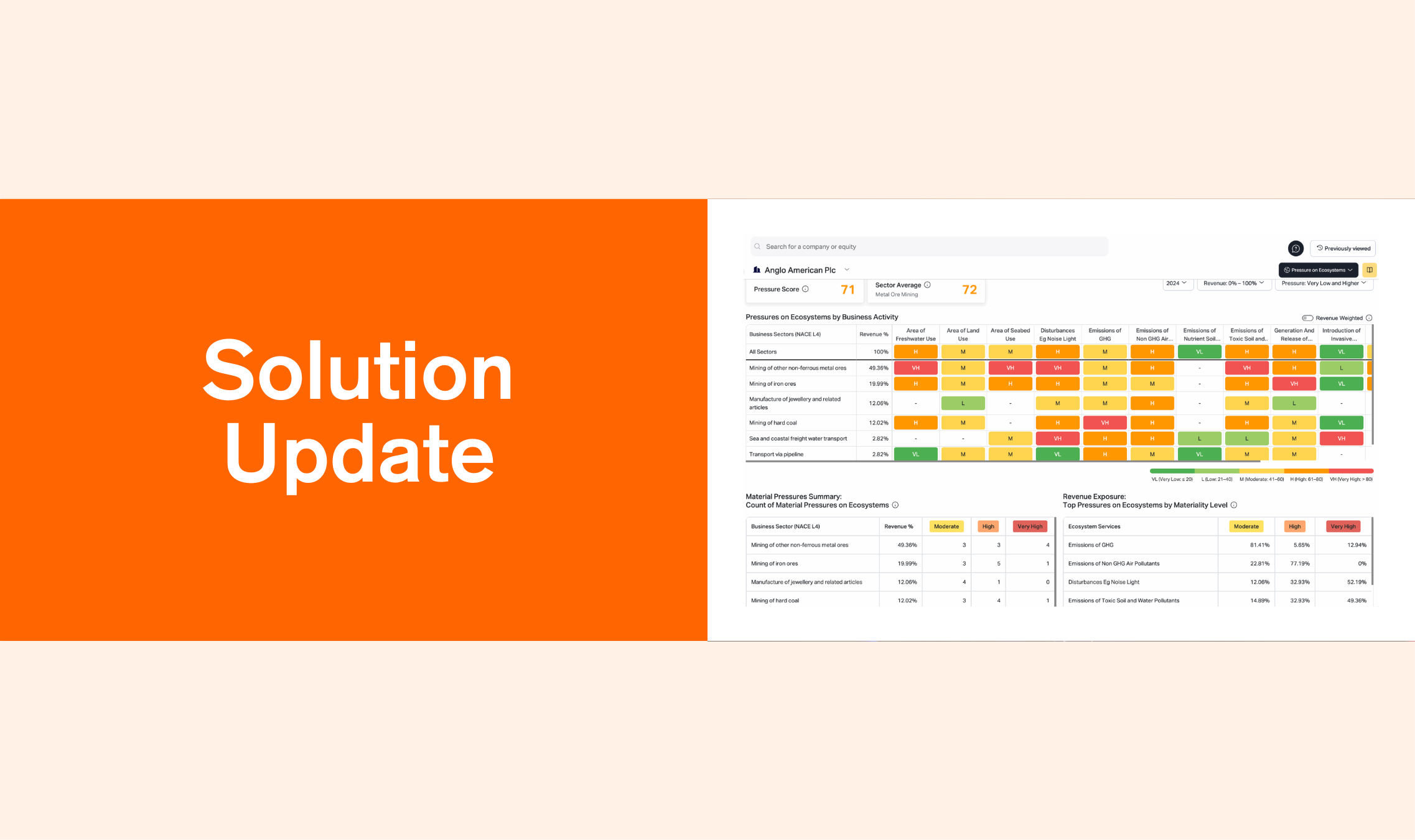

Nature and Biodiversity

Locate, evaluate and assess your nature-related dependencies, impacts, risks and opportunities.

Climate

Risk

Quantify your exposure to the effects of climate change and societal adaptation.

Social

Impact

Showcase the wider value created through your investment into programmes, projects and initiatives.

Double

Materiality

Understand the most important issues in the relationship between your business and the wider world.

Impacts,

Risks and Opportunities

Refine your business strategy with actionable insights woven from a matrix of quantitative and qualitative data.

Impact

Accounting

Translate sustainability performance into the shared language of financial reporting.

Standards and Regulations

Data Foundations

Corporate

ESG Data

Essential quantitative and qualitative sustainability data with full drill-down to source.

Supply Chain ESG Data

Upstream and downstream data with full drill-down to source.

Business Asset Data

Map the full network of business operations, worldwide.

Data

Collection

Standalone tools for accurate data collection at speed and at scale.

Data

Estimation

Standalone tools for filling data gaps using the latest advances in AI and ML.

Data

Validation

Standalone tools to turn data errors into a thing of the past.

Testimonials

Bringing GIST Impact datasets onto the TMX ESG Data Hub means our clients have access to comprehensive and market-leading sustainability, impact and biodiversity data.

Together, we’re paving the way for businesses to measure the transformative power of apprenticeships not just in skills – but in local economic and social impact.

Through this partnership, our partners can now measure and articulate this social impact in a meaningful way.

Our relationship with GIST Impact over the last four years has helped us with a good foundation in assessing and understanding the valuation and impacts of our natural capital; this, in turn has supported our ability to communicate with diverse stakeholders, internally and externally.

The team at GIST Impact brings in a long track record of expertise in this space and is always forthcoming to support us with customized insights for our requirements.

Using GIST Impact's data-led approach for double materiality helped our clients leverage the scientific tools to evaluate what matters to businesses, provide a quantification of the non-financial impacts, and apply it beyond just the regulatory reporting needs.

We look forward to partnering on many more engagements.

This partnership is a significant step forward in our mission to provide companies with a comprehensive CSRD solution—helping them navigate the entire reporting journey, from operationalizing double materiality assessments to audit readiness and XBRL tagging for regulatory submission. By integrating GIST’s intelligence and vast dataset, we can offer an EFRAG-aligned approach to double materiality, reducing both cost and complexity for companies striving to meet the CSRD and other global requirements.

Today’s younger, more purpose-driven generation are holding such organisations to a higher-standards and expect social impact to be at the core of their offering.

Together with GIST Impact, we aim to redefine how the sports industry perceives and harnesses its societal impact.

Awards and Recognitions

Join Us

Latest Insights