Impact Intelligence

Nature and Biodiversity

Locate, evaluate and assess your nature-related dependencies, impacts, risks and opportunities.

Areas of Biodiversity Importance

Analyse proximity to 16,000+ Key Biodiversity Areas, 305,000+ WDPA Protected Areas and 166,000+ IUCN Red List Species.

Ecosystem

Integrity

Integrity

Analyse interface with the changing state of nature, calculated via the Biodiversity Intactness Index and Mean Species Abundance.

Water

Stress

Stress

Assess exposure to areas of high water stress, water demand, water variability and drought likelihood.

Dependency

Assessment

Assessment

Assess dependency on 25 ecosystem services with asset-level precision.

Natural Capital

Impacts

Impacts

Quantify your positive or negative contribution to collective natural capital in monetary terms.

Biodiversity

Footprinting

Footprinting

Calculate your pressure on global species stocks in terms of a Potentially Disappeared Fraction of species.

Deforestation

Identify deforestation risks using geospatial data and analysis of corporate involvements, commitments and targets.

Physical

Risks

Risks

Assess your exposure to a wider array of acute and chronic physical risks such as flooding, temperature variability and wildfires.

Threat Abatement

and Restoration

and Restoration

Pinpoint opportunities for nature positive action by reducing threats to endangered species at a local level.

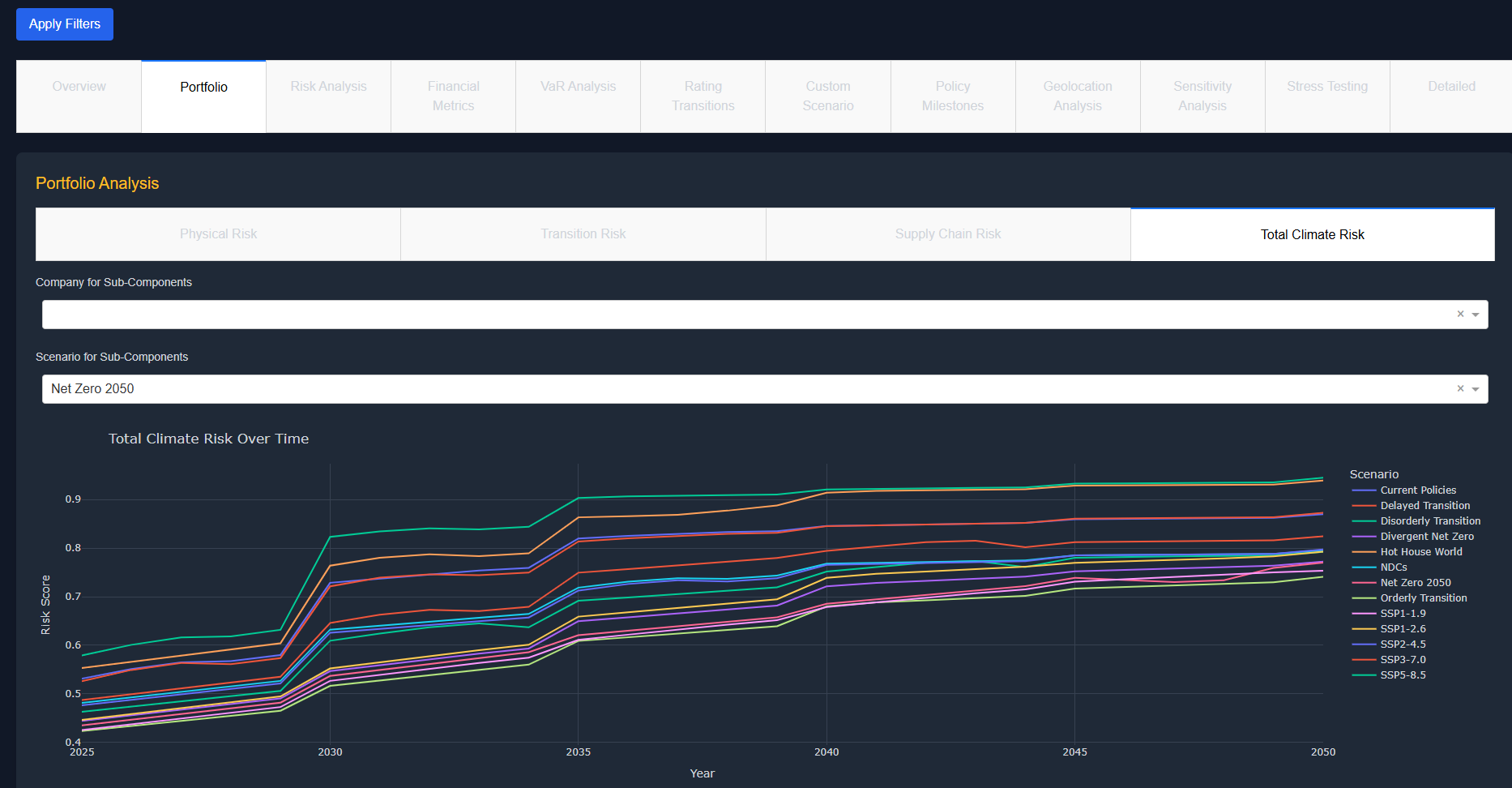

Climate Risk

Quantify your exposure to the effects of climate change and societal adaptation.

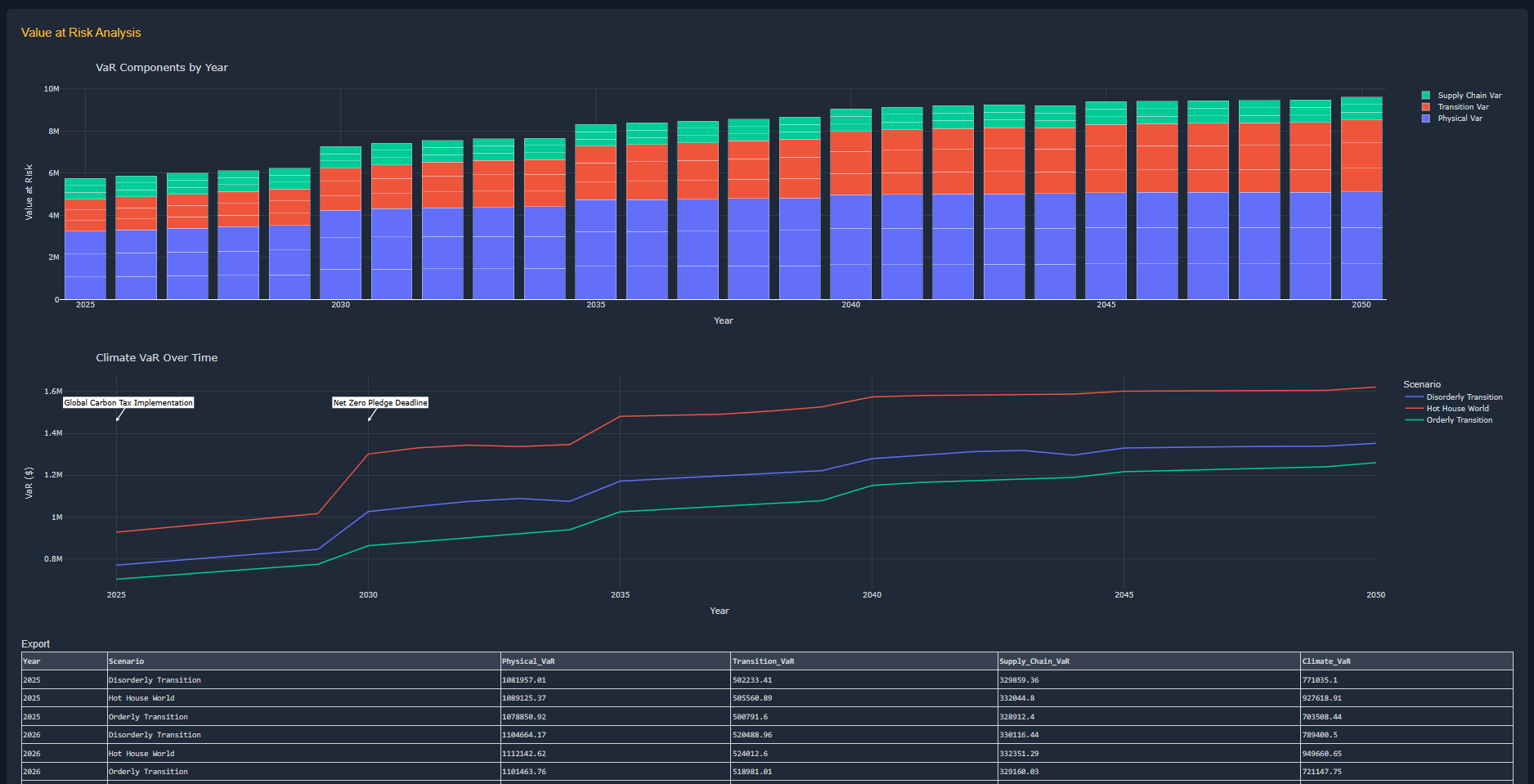

Physical

Risks

Risks

Assess your exposure to 18 acute and chronic physical risks such as flooding, water stress, wildfires and cyclones.

Transition

Risks

Risks

Assess your exposure to 12 transition risks such as the cost of technological adoption, workforce readiness and market volatility.

Supply Chain

Risks

Risks

Assess your exposure to 5 supply chain risks such as logistics, geopolitical and dependency risks.

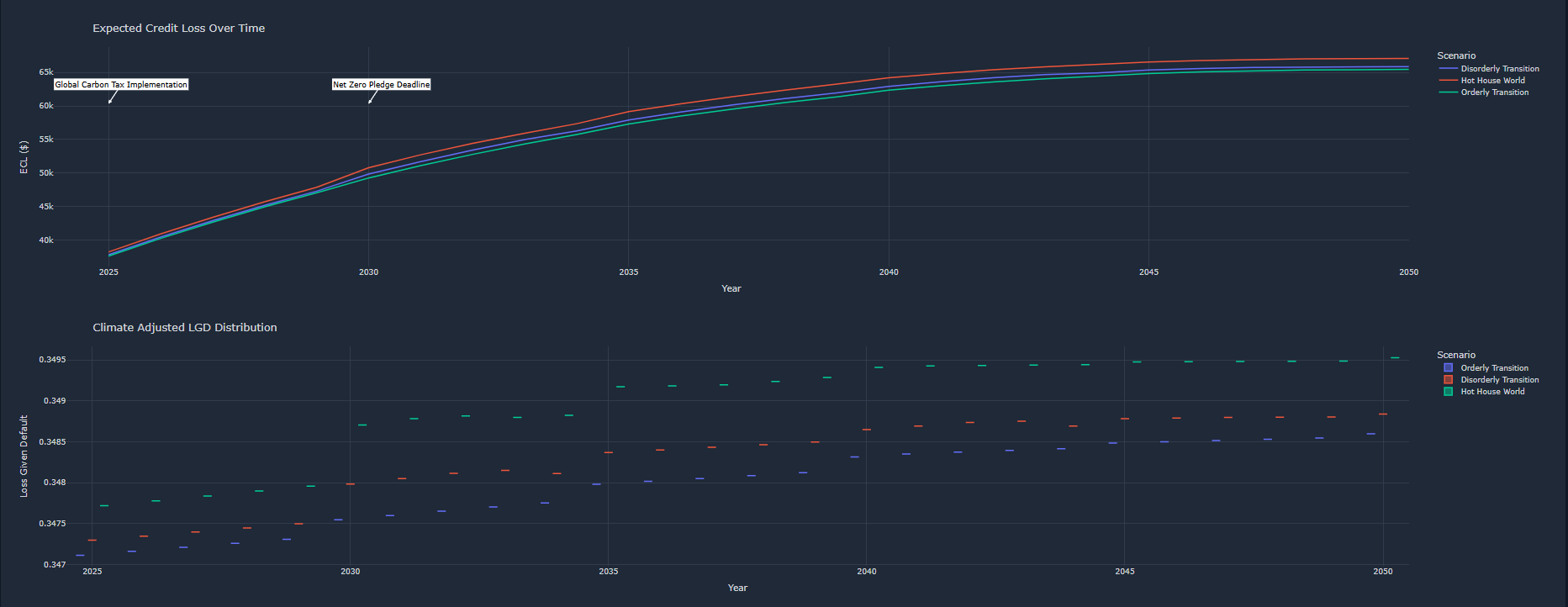

Scenario

Analysis

Analysis

See how your exposures evolve across 12 institutional-grade (NGFS, IEA and IPCC) as well as your own, custom scenarios.

Stress

Testing

Testing

Undertake top-down and bottom-up stress testing, powered by supervised and unsupervised machine learning approaches

Financial

Assessment

Assessment

Translate risk exposures into key financial metrics - such as the Probability of Default, Loss Given Default and Value at Risk.

Transmission

Channels

Channels

Feed your evaluation of climate risk into a wider assessment of risk - such as operational, liquidity, market and operational risk.

Target-Setting

Set data-backed and traceable targets for resilience-building, adaptation and decarbonisation.

Reporting and

Compliance

Compliance

Ensure regulatory (e.g. CSRD, EBA and Basel III) alignment and leverage team-specific, real-time insights for effective communication.

Double Materiality

Understand the most important issues in the relationship between your business and the wider world.

Quantitative

Assessment

Assessment

Form a quantitative, science-backed picture of impact and financial materiality to drive engagement with relevant stakeholders.

Multiple

Perspectives

Perspectives

Assess impact and financial materiality at both company and sector levels to enrich your strategy-building.

Full Value

Chain

Chain

Look beyond the operational boundary to assess material topics upstream and downstream.

Transparent

Drill-Down

Drill-Down

Accelerate audit-ready reporting with one-click transparency to science-backed insights and underlying data disclosures.

Benchmarking

Compare company and sector performance at topic and sub-topic levels.

Standards and

Regulations

Regulations

Identify material topics no matter the taxonomy - whether CSRD, GRI or IFRS.

Impacts, Risks and Opportunities

Refine your business strategy with actionable insights woven from a matrix of quantitative and qualitative data.

AI-Powered

Assessment

Assessment

Generate data-driven, business-specific guidance to mitigate growing exposures and make the most of unrealised possibilities.

Transparent

Drill-Down

Drill-Down

Uncover the underlying assessments powering the high-level score - including scale, scope, likelihood and specific thresholds.

Full Value

Chain

Chain

See how yours IROs stack up across business operations, upstream and downstream.

Standards and

Regulations

Regulations

Discover IROs for your taxonomy and guidance of choice - whether CSRD, GRI or IFRS.

Data Upload

Capabilities

Capabilities

Leverage our existing database or add your own data for enhanced longlisting and materiality assessment.

Flexible

Delivery

Delivery

Access your IROs as a downloadable file, view them on our platform or integrate them into your systems via our APIs.

Impact Accounting

Translate sustainability performance into the shared language of financial reporting.

Monetised

Assessment

Assessment

Quantify business externalities in monetary terms for objective and comparable insights.

Holistic

Scope

Scope

See your positive and negative contribution to natural, human, social and produced capital - as well as the UN SDGs.

Location

Specificity

Specificity

Measure impacts with market-leading granularity - down to 50km2, worldwide.

Full Value

Chain

Chain

See how your impacts add up across business operations, upstream and downstream.

Transparent

Methodology

Methodology

Uncover the science-backed value factors powering our drivers-outcomes-impacts framework.

Impact Valuation

Engine

Engine

Transform your own sustainability data into monetised impacts with our standalone API solution.

Social Impact

Showcase the wider value created through your investment into programmes, projects and initiatives.

on Investment

Characteristics

Outcomes

Input

Delivery

Alignment