Over the last decade, “TEEB for Business” became a favoured reference for thousands of businesses to identify, explore, quantify, value and manage their impacts and dependence on nature. TEEB for Business had emphasised that “it is important to look beyond direct impacts and dependence, to consider the indirect”, however, there is as yet no standardised framework for classifying, measuring and valuing indirect impacts.

These indirect impacts can be highly material (eg: global and local contributions to biodiversity loss & ecosystem degradation due to pressures of GHG and water use of thermal power plants; of the soil and water pollution from chemical industries; of the upstream suppliers of raw materials to manufacturing industries; etc) and the investor universe is increasingly demanding that the full picture be provided, not just for individual investors, but for entire portfolios.

To meet these demands, GIST Impact has built on the firm foundations of the work conducted by TEEB, especially TEEB for Business, and documented a framework that is easy to use, well researched, and is already being used by some leaders in this space.

The evolution of GIST Impact’s framework

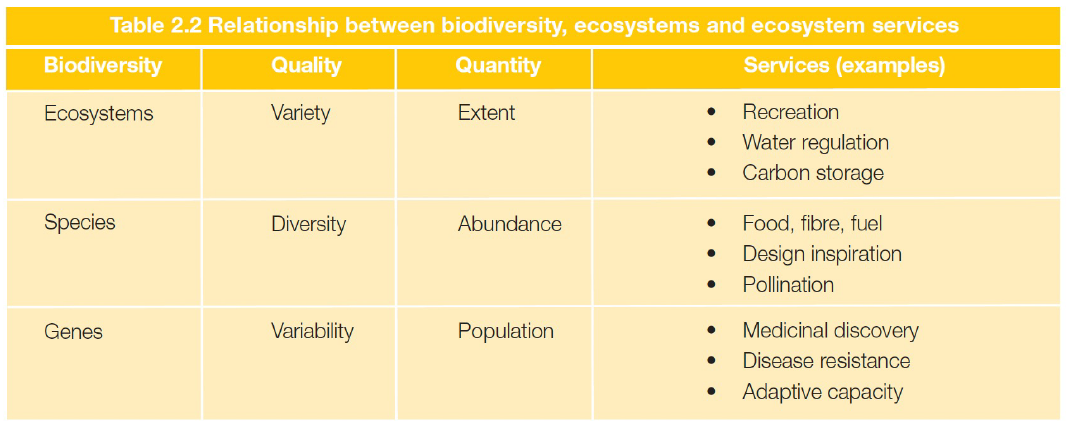

TEEB’s evaluation framework covered biodiversity impacts at the macro-economic as well as the micro-economic level. “TEEB in Business and Enterprise” (Earthscan, 2012, and https://teebweb.org/publications/teeb-for/business-and-enterprise) presented a framework for identifying and evaluating the dependencies and impacts of businesses on nature, i.e. on nature’s contribution to people in the form of ecosystem services from every tier of biodiversity: at the ecosystem, species and genetic levels.

Early last year, the Taskforce for Nature-related Financial Disclosure (“TNFD”) set out a framework for companies and financial institutions to help them discover, measure, manage and assess the impacts and dependencies of their business operations on biodiversity: the so-called “LEAP” (Locate, Evaluate, Assess and Prepare) framework. And in July last year, the Partnership for Biodiversity Accounting Financials (“PBAF”), an initiative to provide guidance to financial institutions to measure their impacts and dependencies on nature and biodiversity, also published their standard for Financial Institutions. There is heartening congruence in these frameworks: PBAF is aligned to the “Evaluate” stage of the TNFD’s LEAP framework, and GIST’s impact framework is very much aligned with both these initiatives.

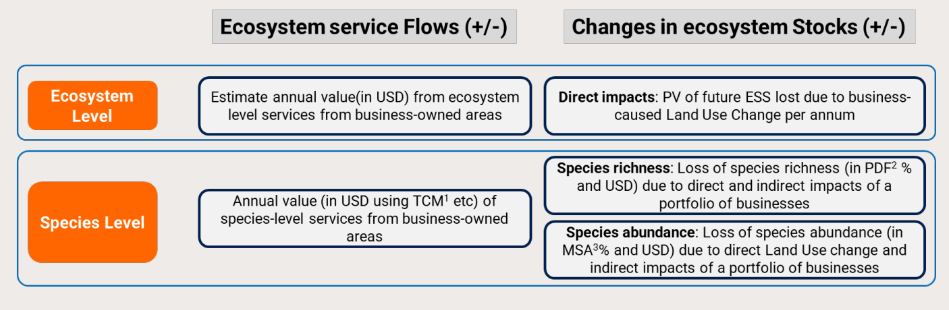

GIST Impact’s proposed biodiversity impacts framework defines all material elements to be captured at different tiers of biodiversity i.e., ecosystem services, species, genetic levels. It covers both flows from owned or operated natural areas, as well changes in stocks due to business activities. All companies in all sectors can use the framework (i.e. it is universal), and it is comprehensive, i.e. it covers all material third-party impacts (so-called externalities). However, different use cases and sectors will explore & estimate its elements to different degrees of depth. For example, the species tier element for a national park with public access may apply the Travel Cost Method to estimate its eco-tourism benefits and surpluses, whereas a technology firm will naturally ignore that element. Conversely, a technology firm will estimate in depth its indirect impacts on nature from fossil-fuel usage and GHG emissions, and they would not even touch a TCM calculation. The species-focussed tier of the framework captures the impacts of business activities on species richness and abundance, which are widely used metrics to define species biodiversity.

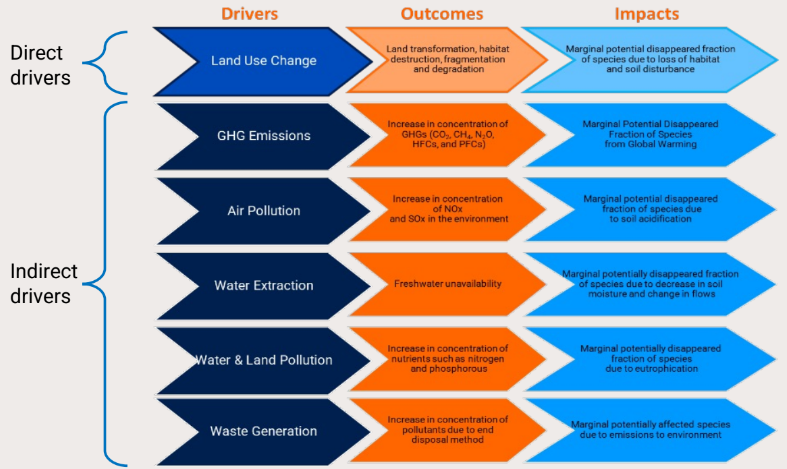

Thus, one of the key features of this framework is that it goes beyond direct drivers (such as land transformation, habitat fragmentation, hunting, etc.) to indirect impact drivers, including pressure indicators such as greenhouse gas emissions (GHGs), water extraction, water & land pollution (Nitrogen & Phosphorus), air emissions (such as oxides of Nitrogen and Sulphur) and impacts from end treatment or disposal of waste.

Business Life-Cycle Impact Assessments (“LCIA”) are used to calculate the impacts of a business on ecosystem health and on species abundance. This is done by first quantifying a standard set of drivers at an asset or company level. These drivers (for example, M3 of water used, or kg NOx emitted) can in turn be converted into an endpoint metric that is consistent across all drivers (in this case, the Potentially Disappeared Fraction of Species, or PDF).

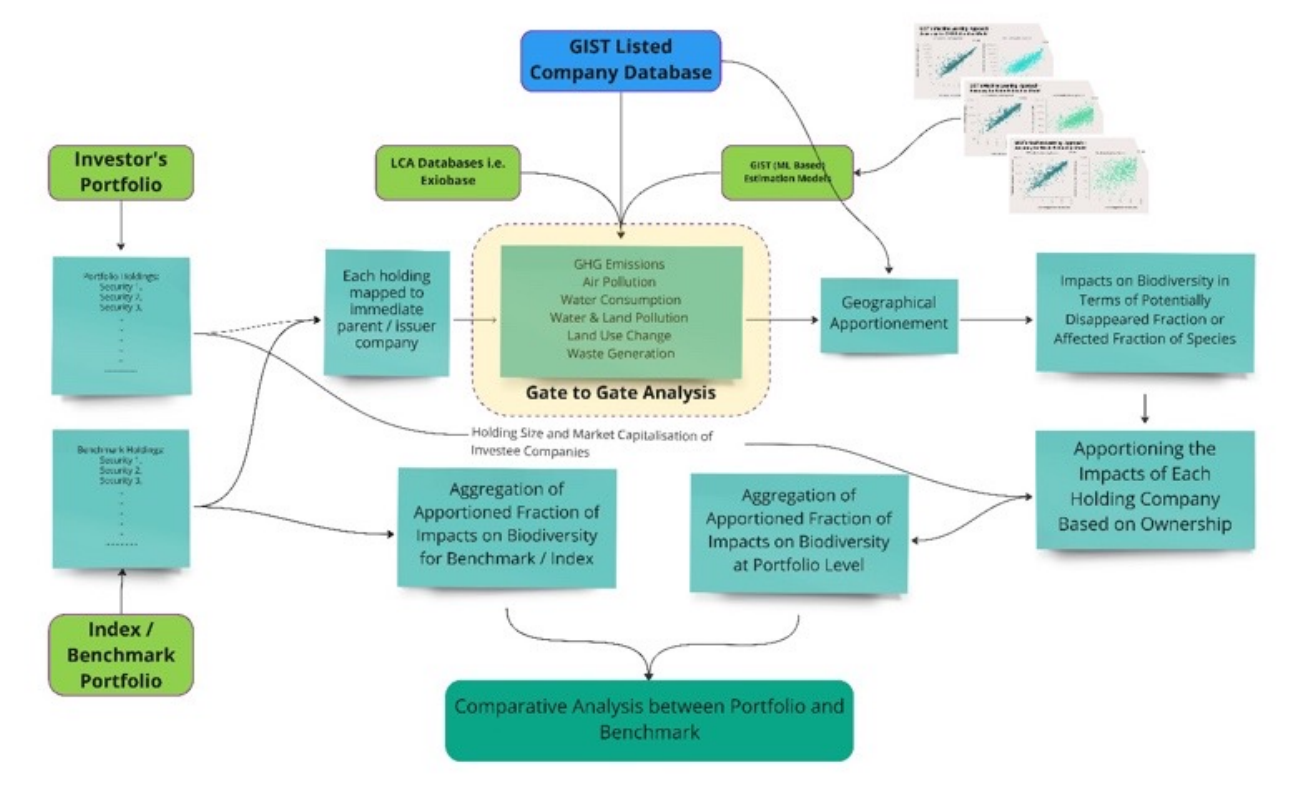

Finally, the approach for assessing impacts of financial investments on biodiversity involves three key steps:

Step 1 is to identify the drivers / pressures which are generated by the operation of an investee company.

Step 2 of the approach translates the drivers / pressures as reported by the companies (or gap filled using GIST machine learning) into impacts on biodiversity.

Step 3 of the approach aggregates the impacts across all the investee companies at the fund or portfolio level. Only an appropriate fraction of the investee company’s biodiversity impact should be attributed to the portfolio or fund as a financial institution has only a fraction of ownership in the investee company.

Click here to view the full presentation on how GIST Impact measures Enterprise Biodiversity Impacts.