This is the third post in our CSRD blog series – feel free to also check out:

- 3 major benefits of streamlined CSRD preparations

- What companies need to know about the CSRD

- Why impact materiality is critical for double materiality assessments

- Interrogating the interoperability of the CSRD with other frameworks

- Navigating the CSRD with 7 key updates to the final ESRS Delegated Act

- Navigating recent updates to the EU sustainability agenda

On 15th Feb 2023, the European Financial Reporting Advisory Group (EFRAG) published the summary report of its conference “Where is Corporate Reporting heading?”, which took place in Brussels on 7 December 2022. Attended by key corporate reporting stakeholders from around the world, the event not only marked EFRAG’s 21st anniversary but also served as an important occasion to debate new trends shaping the ESG revolution and the growing emphasis on connectivity between sustainability and financial reporting.

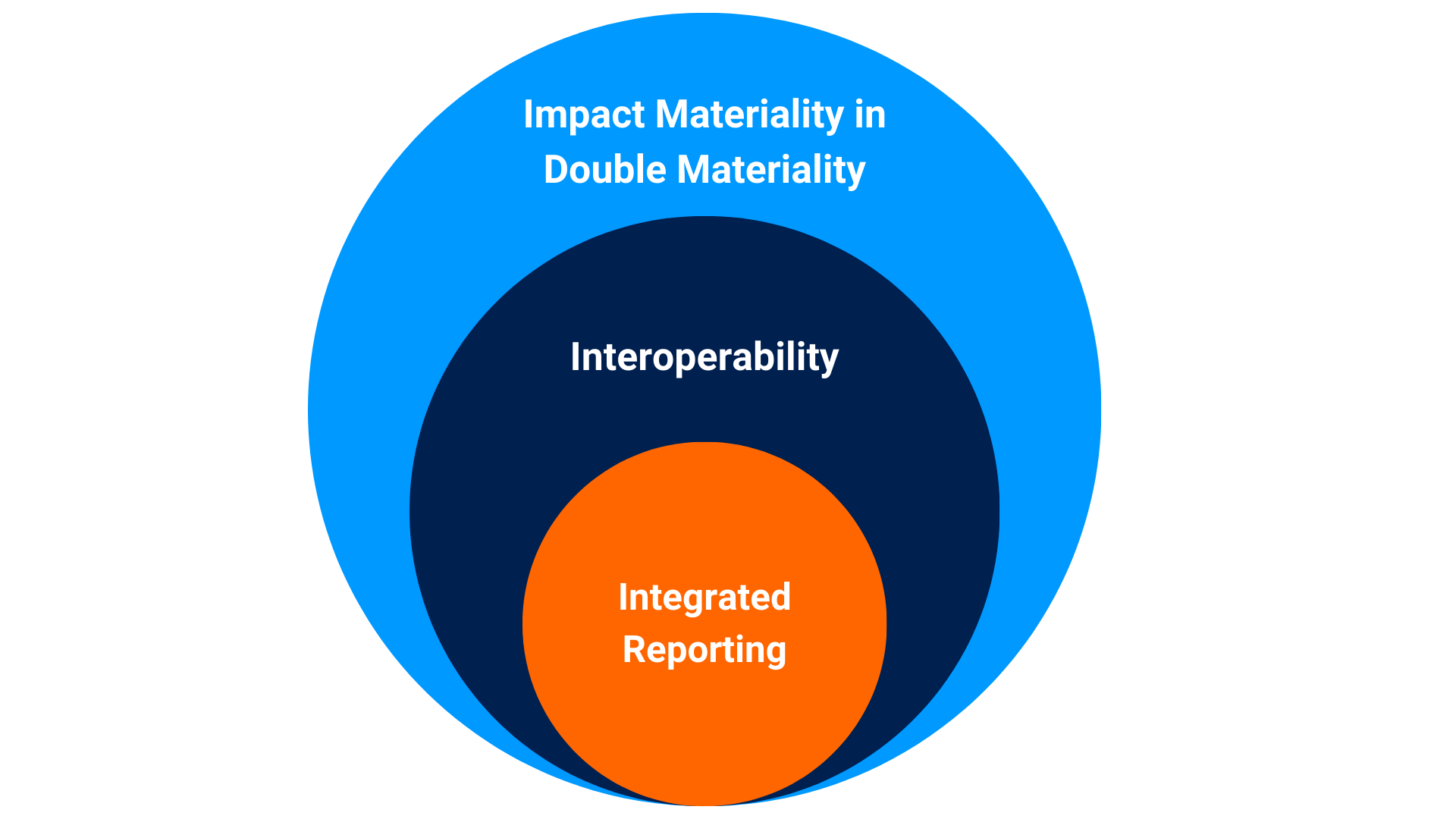

In his closing remarks, Hans Buysse, President of the EFRAG Administrative Board, summed up the most important points driving discussions about the upcoming Corporate Sustainability Reporting Directive (CSRD) – namely the importance of Impact materiality in Double Materiality, Interoperability and Integrated Reporting.

Or in short, the Three ‘I’s.

Impact Materiality in Double Materiality

The concept of “double materiality” is a central tenet of CSRD, requiring companies to not only report on both financial materiality (how sustainability concerns may pose financial risks to the business), but also impact materiality (the impacts of the business on people and the environment).

Double materiality = Impact materiality + Financial materiality

The regulation emphasises that ‘companies should consider each materiality perspective in its own right, and should disclose information that is material from both perspectives as well as information that is material from only one perspective’. Therefore, a materiality assessment will be considered half-finished if it does not account for impact materiality from 2024.

This is significant as it vastly expands the scope of disclosure required for companies – not only accounting for sustainability risks that companies face but also their impacts on society and the environment – and represents a step change in how companies operating in the EU will have to approach sustainability reporting going forward.

(For more context, see GIST Impact CEO Pavan Sukhdev’s op-ed in the March 2023 edition of Investment and Pensions Europe – IPE)

Interoperability

The European Sustainability Reporting Standards (ESRS), which specify what companies must report to comply with the CSRD, aim to foster commonality and interoperability to the maximum extent possible with other key global reporting standards, such as those developed by ISSB, TCFD, and GRI. EFRAG, the technical advisory group tasked with developing the draft ESRS, has recognised that interoperability is an essential feature to reduce complexity and minimise potential costs associated with the reporting for companies.

There are, however, lingering questions about potential conflicts with ISSB’s standards, given IFRS/ISSB’s sole focus on financial materiality (see here for more details). However, recent developments indicate a potential way forward, with ISSB specifying in February 2023 that companies can use the ESRS or the GRI standards as a source of guidance to identify sustainability-related risks and opportunities when reporting under its general requirements standards (IFRS S1), in the absence of a specific IFRS standard. Regardless, large global companies with European operations will still be caught in the CSRD reporting web, and therefore have to conduct the necessary materiality assessments.

European regulators are working to establish an interoperability mapping table between the disclosure requirements, focusing on the European and international climate reporting standards being developed by ISSB. This is intended to help companies navigate the various reporting requirements in different jurisdictions and further support interoperability.

Integrated Reporting

CSRD also suggests that sustainability reporting standards should promote a more integrated view of all the information published by companies in their management reports to ensure stakeholders have a better understanding of the company’s development, performance, position, and impacts, essentially bringing financial and sustainability reporting closer together. A key way in which the ESRS will facilitate this is by requiring a multi-capital approach to materiality assessments, i.e. requiring not only the assessment of financial capital impacts but also impacts on natural, social, and human capital. This is in line with the approach endorsed by the globally-recognised Integrated Reporting Framework, which ISSB has also committed to building on and integrating into its upcoming standards. While impact materiality, measured in €-terms, is not mandated currently under CSRD, it can help support fully integrated reporting, as everything is quantified and therefore comparable in the same terms.

These “Three I’s” should be considered as the guiding principles of the upcoming CSRD regulation in Europe, and are critical to understanding the EU’s approach to future corporate reporting standards.

What we can expect next from CSRD

The implementation timeline of CSRD suggests that the European Commission should adopt the first set of sustainability reporting standards by 30 June 2023, with a second set by 30 June 2024 through means of delegated acts. This will specify complementary information that companies should disclose about sustainability matters as well as sector-specific reporting areas and information to be included.

For more information and updates, check out our CSRD FAQs here.

About GIST Impact

GIST Impact has over 16 years of experience measuring impact materiality and double materiality. We provide impact valuation that quantifies impact in monetary terms (€ / $) to help companies focus on their most material impacts through the lens of a multi-capital approach.

Get in touch with our team to learn more.