Non-disclosure of ESG metrics is rife in the mining sector. Impact investing shines a light on what missing data could reveal. ESG investors use this to support the transition to a sustainable economy. How?

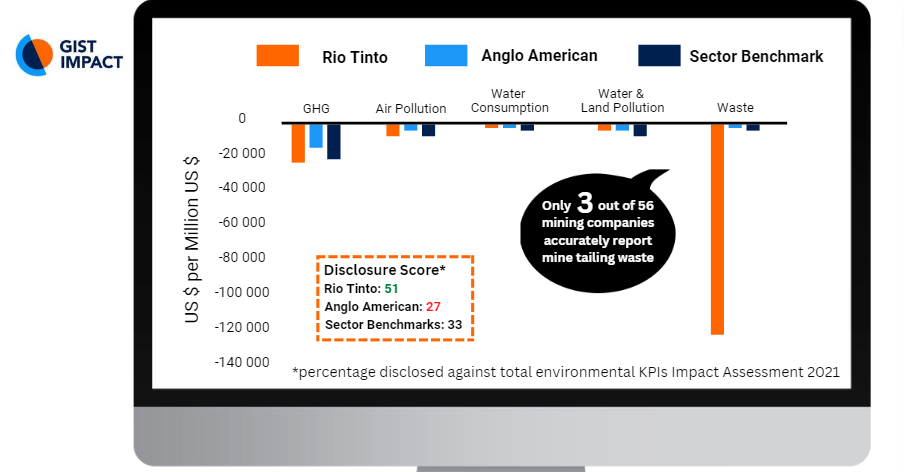

Only 3 from 56 global miners accurately report the Tailing Dam Waste from their operations. All the remaining companies pretend that this waste is non-toxic, or simply does not exist.

Rio Tinto reports over 12 million tonnes of hazardous waste and around half a million tonnes of non-hazardous. Anglo American reports 20,000 tonnes of hazardous waste from a similar business.

Rio Tinto discloses more than half of the natural capital KPIs required to measure a company’s environmental impact. Anglo American reports just 27%.

Consequently, investors are focused on carbon emissions as the largest environmental cost in the sector, when the more immediate and localised damage is being done to the land.

ESG investors may avoid the sector given well-known environmental issues, but a transition to a more sustainable economy requires mined materials. An alternative investment approach is selective industry exposure based on:

- A minimum disclosure score for environmental impacts

- A like-for-like calculation of impacts

- Engaging companies to improve disclosure and treat hazardous waste

All six natural capital factors drive changes in biodiversity, but five of these are indirect. GHG emissions are the most standardised and least useful to differentiate between investments.

If you would like to understand more about impact measurement from traceable data and our publicly available biodiversity framework, please contact us today! Alternatively follow us on LinkedIn to stay updated on the latest insights in impact measurement and sustainability: GIST Impact: Overview | LinkedIn