This is the sixth post in our CSRD blog series – feel free to also check out:

- 3 major benefits of streamlined CSRD preparations

- What companies need to know about the CSRD

- Demystifying the three ‘I’s of the CSRD

- Why impact materiality is critical for double materiality assessments

- Interrogating the interoperability of the CSRD with other frameworks

- Navigating the CSRD with 7 key updates to the final ESRS Delegated Act

- Navigating recent updates to the EU sustainability agenda

Key takeaways

- Standards shift to voluntary disclosure for some areas, with mandatory climate-related immateriality explanations.

- Expanded catalog of phased-in disclosure requirements reduces the burden on reporting.

- The general framework remains in line with the November draft, supplemented by details on company-level EU taxonomy eligibility or alignment.

- A dichotomy emerges between anticipated financial effect (AFE) and potential financial effects (PFE).

- The calculation of the financial effects and associated impact in monetary terms is possible using the natural capital accounting methodology.

- ESRS act includes defined data points that’s coherent with other regulations for financial market participants.

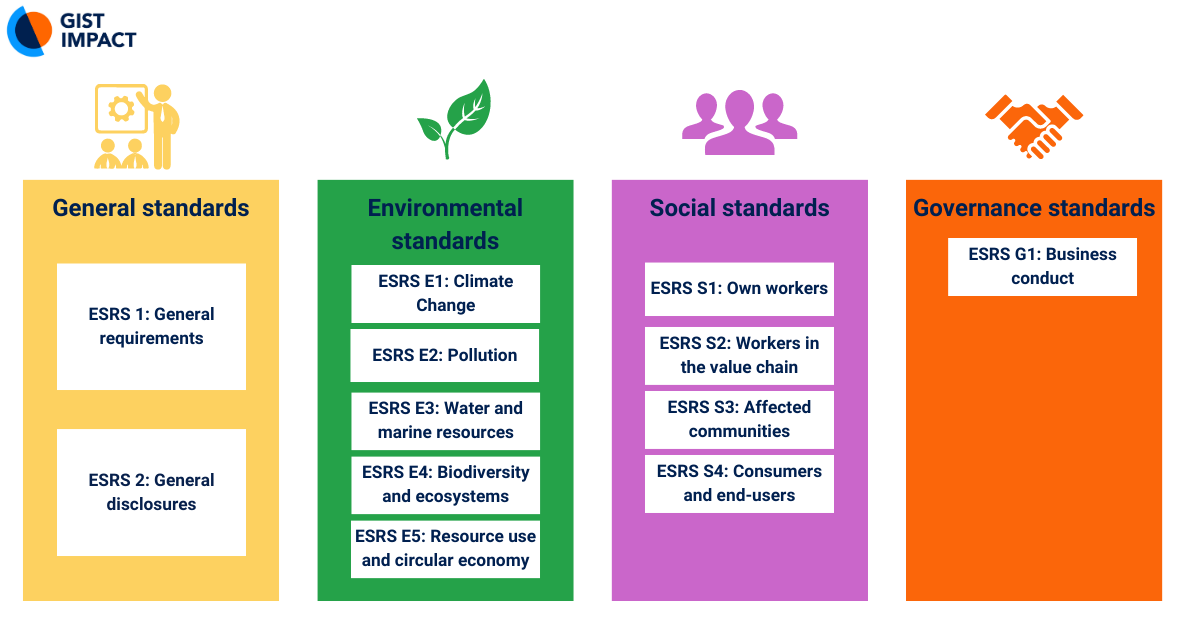

July 31, 2023, marked a significant milestone for sustainability reporting standards in Europe – and indeed globally -, with the European Commission officially adopting the final delegated act of the European Sustainability Reporting Standards (ESRS). These standards underpin the EU’s Corporate Sustainability Reporting Directive (CSRD), which took force in January 2023, with the aim of bringing sustainability reporting on par with financial reporting in the EU. The ESRS includes two primary, cross-cutting standards, which define the general reporting principles and fundamental concepts, such as double materiality, under the new regulation plus the disclosure requirements for all companies falling within the scope of CSRD. These new standards are expected to impact approximately 50,000 companies by 2025¹.

The final ESRS includes several updates to the previous draft, which was released for public comment in June. Read the blog below for a detailed overview of the key updates in the final delegated act and what companies need to know before the standards go into effect in 2024.

1. Shift from Mandatory to Voluntary Disclosures

The most significant shift within the final adopted standards has been a move from mandatory to voluntary disclosure for certain points, For example, disclosures on biodiversity transition plans in ESRS E4 and information concerning non-employee workers in ESRS S1 are now considered voluntary, as part of efforts by the Commission to simplify the overall reporting obligations. The delegated act demands for mandatory explanation of immateriality on climate related sustainability topics. For other immaterial topics the explanation is voluntary.

2. Sustainability Matters in Materiality Assessment

Sustainability matters collectively include sustainability topics, sub-topics and sub-sub-topics. The revised act diverges from the previous drafts in terms of the range of sustainability topics to be included in it. Noteworthy adjustments are apparent in the subtopics and sub-subtopics, exemplified by the inclusion of additional items, such as Microplastics, under the sustainability topic of pollution. This expansion directly gets embedded into the materiality assessment process of the companies.

3. Expanded Catalog of Phased-in Disclosure Requirements

The delegated act broadens the scope of phased-in disclosure requirements, increasing it from 12 in the exposure draft to 31 in the delegated act. For instance, the exposure draft limited phased-in options to ESRS S1 only from the social domain; the revised act extends this provision across all ESRS social topics, spanning from ESRS S1 to ESRS S4. This facilitates the companies to report on disclosure requirements in various phases reducing the overall reporting burden2.

4. Evolution of ESRS Sustainability Statement Structure

The revised delegated act introduces an additional layer of environmental information within the sustainability context, designated as ‘Disclosures pursuant to EU Taxonomy Regulation’. The overall structure remains consistent with the November draft with the supplementary information on EU taxonomy eligibility or alignment at company-level.

5. Double Materiality Assessment

Regardless of the outcome of the materiality assessment, companies are still bound to disclose the requisite information, as delineated by ESRS 2, encompassing all Disclosure Requirements and data points specified by it. Moreover, the Disclosure Requirements, along with their corresponding data points, are pertinent to disclose the materiality assessment around all the topical ESRS, along with the required process to identify and assess material impacts, risks, and opportunities for each of the material sustainability topics.

6. Financial Effects: Anticipated vs. Potential

A dichotomy emerges between anticipated financial effect (AFE) and potential financial effects (PFE). In the delegated act, the AFE is defined as “Anticipated Financial effects that do not meet the recognition criteria for inclusion in the financial statement line items in the reporting period and that are not captured by the current financial effects”. However the term PFE for each topical ESRS is defined as “PFE is dependent on two factors: (i) the likelihood of occurrence and (ii) the potential magnitude of financial effects determined based on appropriate thresholds outside the scope of existing accounting requirements”.

The calculation of the financial effects and associated impact in monetary terms is possible using the natural capital accounting methodology (NCMA)3 and the same has been recommended in the Recital 38 of the CSRD proposal. This further can help businesses to understand and quantify their impact on natural capital accurately.

7. Coherence with other EU legislation

The delegated act of ESRS contains a series of clearly identified data points that correspond to specific information that financial market participants (FMPs), benchmark administrators and financial institutions need for their reporting purposes respectively under the Sustainable Finance Disclosure Regulation (SFDR), the Benchmark Regulation (BMR) or the “pillar 3” disclosure requirements under the Capital Requirements Regulation (CRR).

If financial market participants conclude that a datapoint deriving from the SFDR, the BMR or the CRR is not material, it will have to explicitly follow the law of “Comply or Explain”. In addition, such financial companies will have to provide a table with all such data points, indicating where they are to be found in its sustainability statement or stating “not material” as appropriate rather than just reporting no information.

What Lies Ahead?

Following the adoption of the delegated act, a two-month evaluation phase will be initiated by the European Parliament and the Council of the European Union. Subsequent to this period of scrutiny, assuming no opposition from either co-legislator, the delegated act will become effective on January 1, 2024.

Parallel to the legislative process, the European Financial Reporting Advisory Group (EFRAG) is actively engaged in developing supplementary guidelines to facilitate ESRS implementation. The forthcoming guidelines are expected to include further information on the materiality assessment, an interoperability table, and integration of value chain information. Additionally, EFRAG has communicated its intention to establish a dedicated access point for ESRS stakeholders, facilitating the submission of application-related queries and offering guidance tailored to small and medium-sized enterprises (SMEs) and minor financial institutions (FIs).

Further clarifications will be provided to financial market participants who also need to comply with frameworks such as SFDR, the BMR and/or the CRR. Delegated act is expected to recommend an approach that needs to be taken when a company has assessed a datapoint derived from SFDR, BMR or CRR as not material and has therefore stated “not material” in its reporting.

- https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en

- https://ec.europa.eu/finance/docs/level-2-measures/csrd-delegated-act-2023-5303-annex-1_en.pdf

- https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_4043