Challenge

An institutional investor (£700+ billion AUM) with a commitment to becoming a nature-positive firm needed to assess the biodiversity impact and environmental materiality of their portfolio. Their goal was to inform strategic investment

decisions, including reallocation from high- to low-impact sectors and investees.

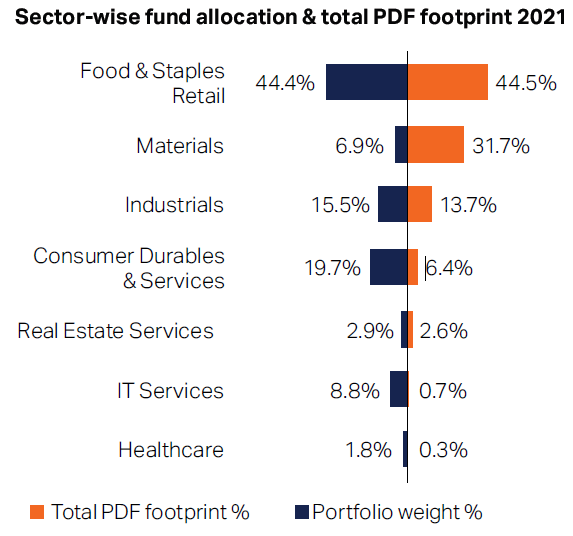

Conducting Biodiversity Footprinting

GIST Impact produced company-specific biodiversity footprints for portfolio investees using peer reviewed Life Cycle Impact Assessment methodologies. The biodiversity metric, Potentially Disappeared Fraction (PDF), indicates the impact on global species diversity from a company’s operations and value chain. As with other aspects of materiality assessment, biodiversity impacts can vary widely within a given sector, depending on the location and environmental pressures of a company’s operations. These granular insights empowered the firm to analyse the biodiversity implications for their portfolio and to productively engage with its investees.

Solution

Materiality Assessment Using Company-Reported Data

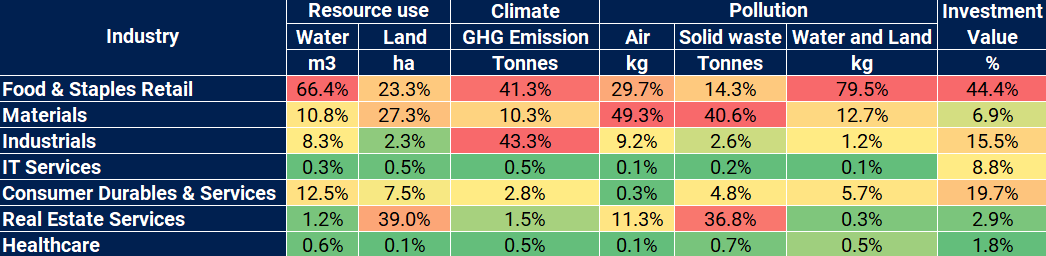

GIST Impact’s proprietary database of environmental drivers for 14,500+ companies was used to generate a detailed Materiality Heatmap that clearly identified which aspects of the firm’s portfolio have the largest impact on ecosystems, resource usage, climate, and pollution. The use of company-level data, rather than sector averages typically employed by other methods, provided the firm with confidence that the insights were highly relevant and actionable.