Accounting standards change slowly, while regulations often update after a disaster. The recent focus on sustainability and financial reporting has brought to light the importance of using data to prepare and protect assets and investments. However, with the debate on whether to use qualitative or quantitative data and whether to adopt single or double materiality, it can be challenging to know where to find the necessary information.

Single materiality covers the potential costs to companies from external threats, while double materiality adds the costs to society from companies’ activities.

The latter are known as externalities.

There are concerns in more litigious parts of the world that voluntary disclosure of harm done to the environment will accelerate realisation of the costs of that harm. These fears are often hidden behind arguments that stakeholders will not understand the disclosures, or that the costs of reporting for small businesses will be too high.

There is nothing stopping larger, listed companies leading the way and the “public is dumb” argument is misdirection at its worst.

If companies are harming the environment and society by their activities, then this will come to light. Major changes to reporting regimes often follow disasters rather than foreshadow them.

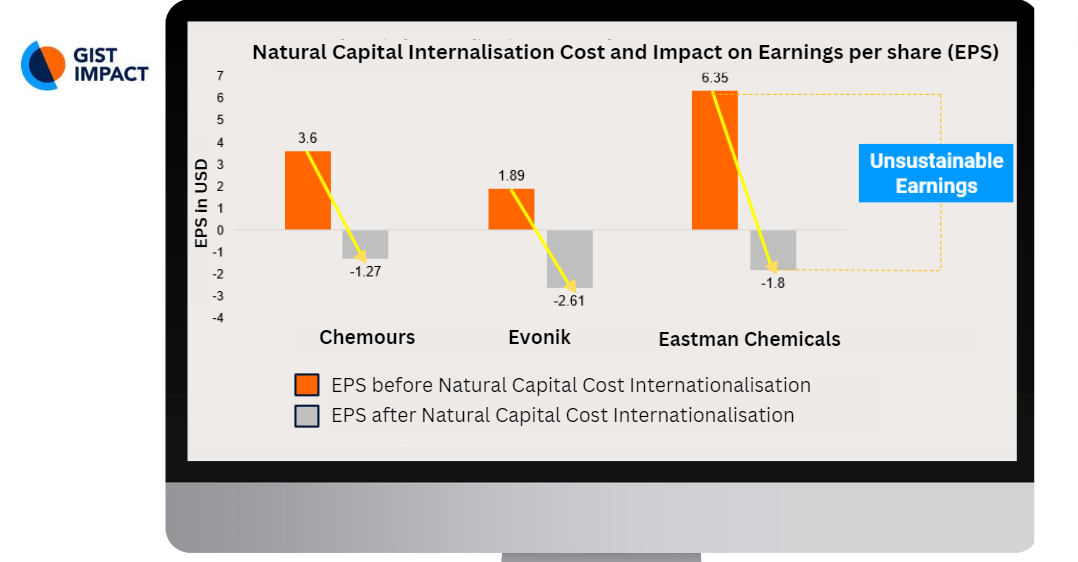

You may already estimate the impact on financial statements of realising the costs of environmental damage. These costs are estimated from public disclosures of sustainability data. There is an example of how this may look in the chemicals sector below.

If you would like to understand more about the measurement of externalities please contact us today! Alternatively follow us on LinkedIn to stay updated on the latest insights in impact measurement and sustainability: GIST Impact: Overview | LinkedIn