This is the second post in our CSRD blog series – feel free to also check out:

- 3 major benefits of streamlined CSRD preparations

- Demystifying the three ‘I’s of the CSRD

- Why impact materiality is critical for double materiality assessments

- Interrogating the interoperability of the CSRD with other frameworks

- Navigating the CSRD with 7 key updates to the final ESRS Delegated Act

- Navigating recent updates to the EU sustainability agenda

If your company operates in the EU, you might be aware of a new law that will take effect soon called the Corporate Sustainability Reporting Directive (CSRD). You also may be wondering what it means for you and how it could impact your business.

Our experts have compiled the most frequently asked questions about the CSRD and the related European Sustainability Reporting Standards (ESRS), which companies will be expected to comply with as soon as the 2024 fiscal year.

Read on to find out more about the key developments – and look out for upcoming blog posts diving into the details of the new regulations as part of our new CSRD series.

FAQs

- What is CSRD?

- Who is EFRAG? What is the ESRS?

- How is CSRD different from NFRD?

- Who does CSRD apply to?

- When do the reporting requirements take effect?

- Will the impact of CSRD go beyond the EU / affect non-EU companies?

- Why is the adoption of CSRD so signfiicant?

- Will companies be penalised for non-compliance with CSRD?

- What is the scope of the sustainability reporting assurance under CSRD?

- What’s next for CSRD?

What is CSRD?

The new Corporate Sustainability Reporting Directive (CSRD) governs the requirements for sustainability reporting in the EU. It is an evolution of the reporting rules previously introduced under the Non-Financial Reporting Directive (NFRD), and significantly enhances and broadens the scope of social and environmental information that companies will have to report on from 2024 onwards. Importantly, the CSRD now requires explicit consideration for double materiality and financial effect.

Who is EFRAG? What is ESRS?

Companies subject to the CSRD will have to report according to European Sustainability Reporting Standards (ESRS), which are being developed by EFRAG, previously known as the European Financial Reporting Advisory Group – a private association tasked by the European Commission to provide the European Sustainability Reporting Standards (ESRS).

The new standards will be tailored to EU policies, and also build on and contribute to international standardisation initiatives such as through the International Sustainability Standards Board (ISSB). The Commission is set to adopt the first set of standards by mid-2023, based on the draft standards published by EFRAG in November 2022.

How is CSRD different from NFRD?

Under the NFRD, companies have already started to report on at least the following items: environmental matters, social and employee-related matters, respect for human rights, anti-corruption and bribery matters, as well as diversity on company boards. For each item, companies must include information on their policies, outcomes and risks.

Under CSRD, there will be additional reporting requirements as per the below:

- Double-materiality concept: reporting on how sustainability matters affect companies and the impact these have on people and the environment

- New provisions on companies’ strategy, targets and engagement of board and management, including information on the resilience towards different climate-related scenarios

- Disclosures on the main adverse impacts linked to the company and their value chain, as well as the process to identify the reported information

- Information on intangibles including social, human and intellectual capital

- Inclusion of forward-looking and retrospective information, covering different time-horizons

- Alignment towards Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy Regulation

In addition, CSRD provides for the digitalisation of sustainability information.

Who does CSRD apply to?

CSRD applies to all listed companies and all large companies meeting at least 2 out of 3 criteria:

- >250 employees;

- >EUR 20m total balance sheet assets;

- >EUR 40m net turnover.

This will increase the number of companies subject to the sustainability directive from 11,600 to 50,000 – covering >75% of total EU companies’ turnover.

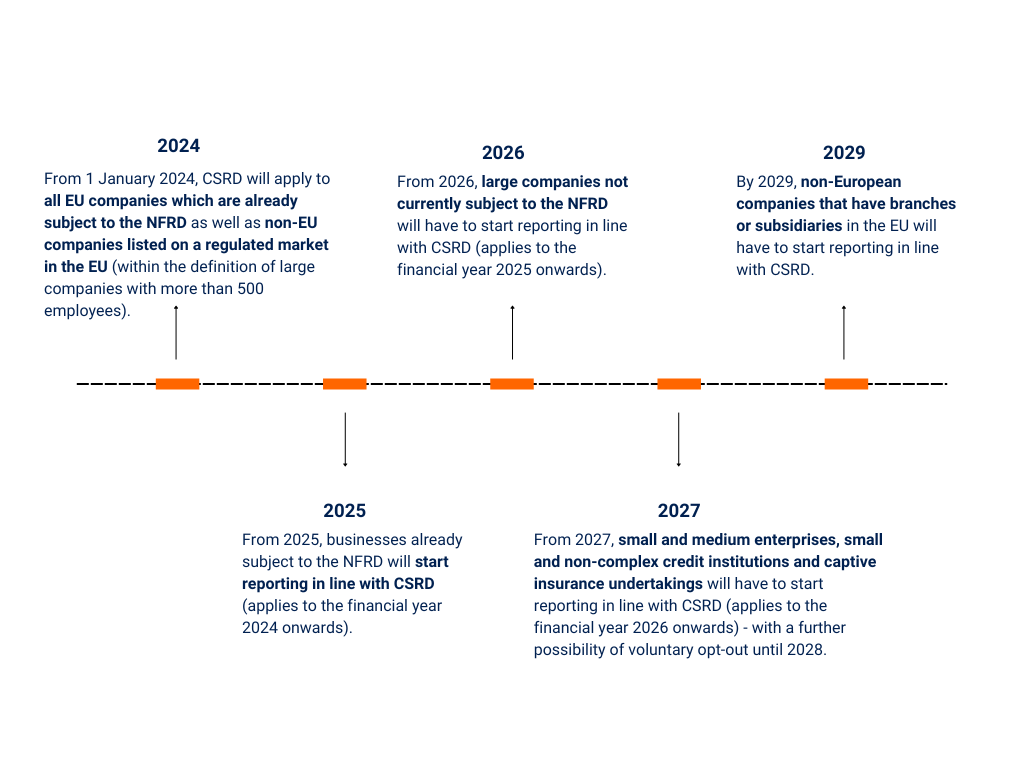

When do the reporting requirements take effect?

Will the impact of CSRD go beyond the EU / affect non-EU companies?

Companies headquartered outside the EU will be required to comply with the CSRD if they have operations or business activities within the EU.

For listed companies, CSRD raises the bar significantly for disclosures to investors, who will likely come to expect similar levels of transparency from non-EU companies.

Reporting companies will also require accurate data from their suppliers to meet disclosure requirements, driving CSRD requirements into all corners of the global supply chain.

Why is the adoption of CSRD so significant?

CSRD is transforming sustainability reporting. It demands disclosures on more sustainability drivers (i.e. heightened transparency), while expecting this information to be 3rd party assured (i.e. heightened accountability).

CSRD explicitly requires double-materiality reporting and so vastly expands the scope of disclosure from considering only sustainability risks that companies face (i.e. outside-in materiality – or ESG reporting as it is most commonly adopted today), to also disclose the impact of those same companies on society and the environment (i.e. inside-out materiality – consistent with an impact economics approach). Taken together, this is a much more meaningful and accurate disclosure of company risk emanating from sustainability issues.

CSRD requires sustainability risks and opportunities to be reflected in disclosures as ‘financial effects’, thereby tightening the line between financial and non-financial reporting through the basis of monetary consideration of risk facing companies. Latest developments show EFRAG continuing to tighten the link between financial and non-financial reporting.

Find more details on impact economics here.

Will companies be penalised for non-compliance with CSRD?

It is still uncertain when the EU Commission will start to place penalties on businesses failing to comply with CSRD, but it is expected that these penalties will be significant. The nature and the value of the penalties will depend on different Member States.

What is the scope of the sustainability reporting assurance under CSRD?

Under CSRD, companies will be required to obtain external assurance for the sustainability information they report. The requirements begin with limited assurance and expand to reasonable assurance at a later date. The statutory auditor of the financial statements will be allowed to perform these assurance engagements. The Commission is expected to adopt assurance standards for limited assurance by means of delegated acts before 1 October 2026.

What’s next for CSRD?

The Commission is now in the process of consulting the relevant EU bodies and Member States, and is expected to adopt the final ESRS as delegated acts in June 2023. This will then be followed by a scrutiny period of the delegated acts by the Parliament and Council.

Over the next 12 months, EFRAG will focus on the drafting of disclosure standards for small and medium-sized businesses (SMEs), as well as sector-specific reporting standards for the five industries covered by the Global Reporting Initiative (GRI) (agriculture, coal mining, mining and both upstream and mid-to-downstream oil and gas), and five high-impact sectors (energy production, road transport, motor vehicle production, textiles, and food and beverage).

How companies can prepare for this next wave of sustainability reporting

Companies should take action now to prepare for CSRD, particularly when it comes to assessing double materiality and financial effect. At GIST Impact, we can help get you started with our CSRD Materiality Check – our approach puts quantitative impact analysis at the heart of your materiality assessment and regulatory preparations through the use of our proprietary impact valuation engine.

Get in touch with our team to learn more.