This is the fourth post in our CSRD blog series – feel free to also check out:

- 3 major benefits of streamlined CSRD preparations

- What companies need to know about the CSRD

- Demystifying the three ‘I’s of the CSRD

- Interrogating the interoperability of the CSRD with other frameworks

- Navigating the CSRD with 7 key updates to the final ESRS Delegated Act

- Navigating recent updates to the EU sustainability agenda

In the previous blogs, we discussed the guiding principles behind the new EU regulations, including the focus on double materiality, as well as the benefits for companies of the new streamlined reporting approach. Here, we discuss why impact materiality, and by extension quantitative measurement, is so critical for robust double materiality assessments.

What is Double Materiality in CSRD?

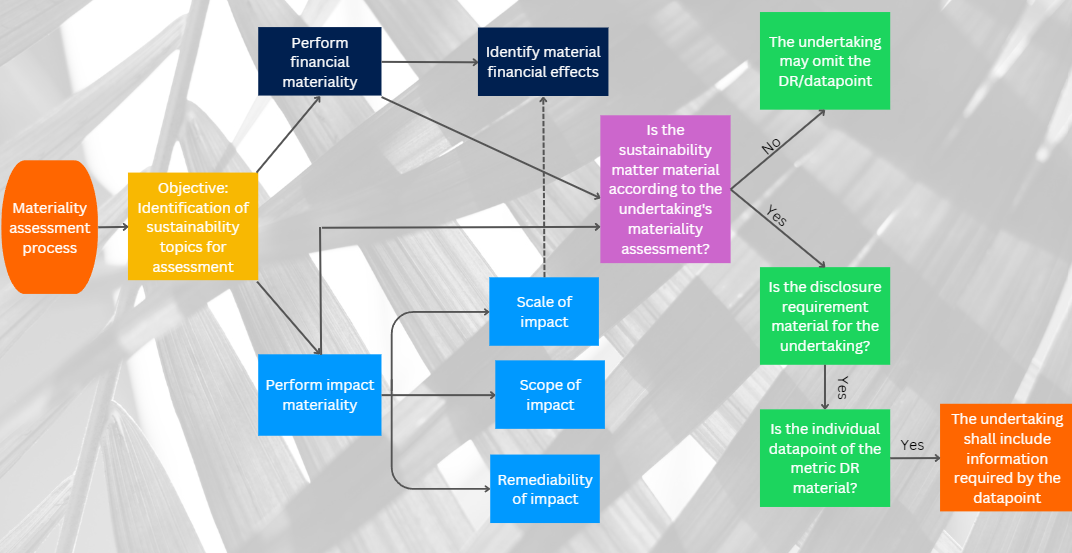

The double materiality assessment plays a fundamental role in CSRD reporting by determining which Environmental, Social and Governance factors to disclose based on their actual or expected effect on enterprise value.

Critically, under double materiality reporting companies must now consider both impact materiality and financial materiality, a big shift from previous practices for most companies.

What is Impact Materiality?

Impact materiality captures the so-called inside-out impact of a business, considering both positive and negative impacts on people, planet and society over the long, medium and short term. In purely economic terms, these impacts are referred to as externalities.

If businesses do not accurately account for the risks associated with these kinds of externalities – or in other words, “internalise” them – this creates significant problems.

For example, the overuse of agricultural chemicals can create negative externalities including loss of ecosystem productivity, health risks associated with the accumulation of chemicals in the food chain, and accelerated climate impacts. Or a company’s air emissions can create negative externalities when it comes to the impact on human health and the economy (see here for more on accounting for the economic and health impacts of air pollution).

As companies work to comply with the CSRD regulations and related disclosure requirements, these risks will increasingly rise to the surface.

How do you measure impact materiality under CSRD?

CSRD requires robust impact materiality assessments covering:

- Severity

- Likelihood of impact

Severity of impact can be calculated using:

- Scale of impact

- Scope of impact

- Irremediable character of the impact

Why is monetary impact valuation important?

Under the CSRD, equal importance is given to financial materiality and impact materiality.

To ensure a robust approach, impact and financial materiality assessments must complement one another and ideally speak the same language – monetary units (e.g. in Euros or Dollars).

Measuring a company’s impact on the environment and society in monetary terms provides clear evidence of the materiality, or severity, of the impact, while also enabling comparability with the financial materiality assessment.

What risk does a company face without monetary impact valuation?

If a company omits specific metrics or information in its sustainability report, as prescribed by a Disclosure Requirement of ESRS, such information is then considered to be implicitly reported as “not material” for the company.

For example, our data in the mining sector shows that only 3 from 56 global miners accurately report the Tailing Dam Waste from their operations. All the remaining companies pretend that this waste is non-toxic, or simply does not exist. Under new reporting requirements these omissions will be severely called into question.

Quantitative vs. Qualitative materiality assessments?

Quantified monetary impact materiality becomes a clear necessity therefore to guarantee nothing is missed and everything is accurately reported.

Robust impact materiality assessment includes quantitative impact valuations and is complemented by qualitative inputs.

Today, businesses too often forget to add this quantitative impact lens, instead focusing on lists of material issues and individual stakeholder views compiled through surveys and other qualitative methods.

Conclusion

Analysing material issues with the support of quantitative impact data as well as sector and peer-based insights provides a stronger evidence base for companies, enabling them to build better strategies and ensure effective double materiality assessments under CSRD reporting.

Incorporating impact materiality into materiality assessments is critical for companies that want to take a comprehensive approach to sustainability reporting and demonstrate their commitment to sustainability leadership. By examining the full range of impacts of their direct operations and value chains, companies can effectively identify risks and opportunities, and build trust with stakeholders and society.