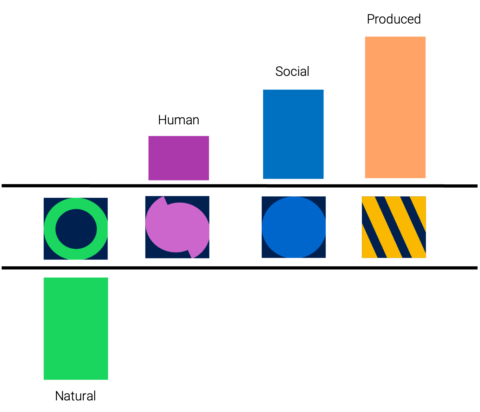

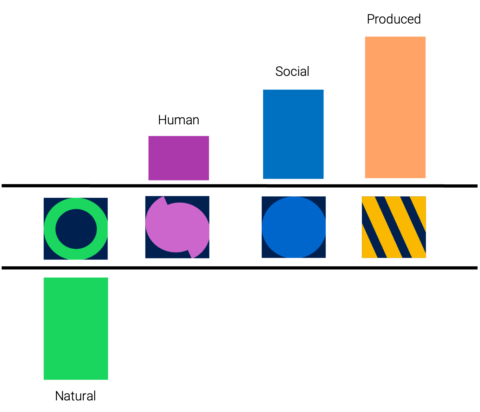

Integrated Profit and Loss Reporting

Understanding the full spectrum of corporate performance goes beyond financial statements. The “Integrated Profit & Loss Reporting” framework is designed to measure the impacts of business activities not just on…

It was a pleasure to be invited for Wall Street Horizon’s Data Minds webinar – Triple Threat: Leveraging Data to Manage AI, ESG, and ETF Risks – and to our fellow panellists for the lively discussion!

A snapshot of some of the key insights from GIST Impact SVP Commercial Development Mahima Sukhdev during the panel:

”Just in the last year, we’ve seen a major crackdown on greenwashing in the financial sector – from major asset managers facing fines and coming under regulatory investigation, to tens of thousands of funds having their ESG ratings downgraded overnight. This underscores the imperative for transparency and accountability in sustainability reporting.”

”Historically, we’ve operated in a sustainability data Wild West, so it’s no surprise that regulators are now stepping in and starting to tighten the screws. This is only the beginning – the ESMA greenwashing guidelines came out less than a year ago, and we can expect a lot more legal and reputational risk for firms making over-the-top ESG claims.”

“A few firms may be slowing down on their sustainability agendas, but thankfully, most are realising that to respond to greenwashing concerns, they need to move on from opaque ESG ratings methodologies, and instead go straight to source (traceable, reported sustainability data) and straight to science (measuring location-specific impact on nature and society).”

“Data has to be the tool to drive change, we just need the right data to do that. This era of ESG ratings has been a distraction, the regulators have cracked down, but we’re now coming out of it and we’re seeing a focus on traceable, validated, science-based impact data – and that’s a promising shift.”

”At the end of the day, the most important thing is to ensure investors have access to the best possible data on environmental and social performance so that they can make the most informed decisions and minimise the biggest risks – for their shareholders, and for society as a whole.”

Watch the full webinar below:

Understanding the full spectrum of corporate performance goes beyond financial statements. The “Integrated Profit & Loss Reporting” framework is designed to measure the impacts of business activities not just on…

We are delighted to announce that GIST Impact plays a prominent part in a new Microsoft white paper titled “Solving for Inclusive Economic Growth in the Era of AI”. Featuring…

We are proud to announce that GIST Impact has been profiled in an Environmental Finance article titled “Nature Data – overwhelmingly complex, but a need-to-know”. Offering insights from Pavan Sukhdev…

We were honoured to take part in a panel titled “From ESG & Sustainability to Impact: The Future of Finance” at Reset Connect, the signature event for London Climate Action Week. GIST…

GIST Impact is proud to have been featured in a report by Cape Capital, a Swiss wealth and investment management firm. Among Cape Capital’s offerings – across fixed-income, equity and…

It is our pleasure to announce the publication of a short article co-authored with TMX Datalinx, the Information Services division of TMX Group (the operator of multiple stock exchanges including…