Integrated Profit and Loss Reporting

Understanding the full spectrum of corporate performance goes beyond financial statements. The “Integrated Profit & Loss Reporting” framework is designed to measure the impacts of business activities not just on…

Impact economics measure company performance by placing a monetary value on the company’s most significant positive and negative impacts on society.

This involves quantifying externalities and leads to a comprehensive, widely accepted framework in which comparisons between companies and sectors are made accurately and consistently.

The final metric is expressed as a dollar value, making material comparisons across companies and sectors not only possible but scientifically rigorous and transparent.

Responsible companies treat shareholders and stakeholders alike – ensuring employees, customers and investors are given an equal say.

Impacts must be accounted for in company decision-making – because what economists term externalities today are tomorrow’s risks and the day after’s costs.

Quantifying the effects of a company’s operations on societal wellbeing helps to uncover hidden costs and benefits, and to understand how they arise.

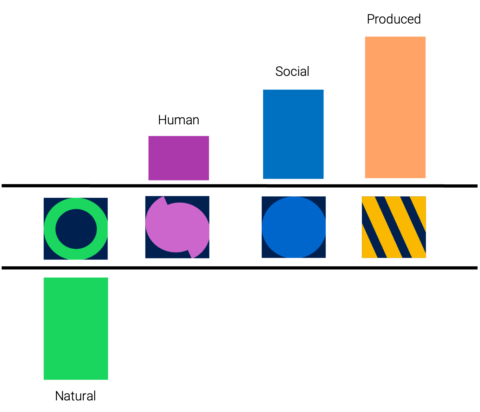

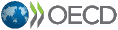

Companies always measure impact on financial capital – but they don’t measure impacts across the remaining three capitals:

Impact economics provides a holistic lens to help identify, measure and quantify hidden risks and opportunities when it comes to a company’s interactions with society and the environment (its so-called “externalities”).

By assigning a monetary value to these externalities, impact economics puts impact information on par with financial metrics – enabling leaders across the financial and corporate landscape to integrate sustainability into their overall strategy in clear, informed and actionable way.

Stricter environmental regulations

Carbon taxes, stringent discharge limits for effluents and air pollutants, etc.

Increased litigation costs

Higher damages for managing accidental spills and discharges

Increased compliance costs

E.g. installation of emission monitoring systems

Increased costs of raw materials

E.g. higher cost of water

Stranding of assets

As a result of protests and regulations

Shift in customer preference

Consumers opting for environmentally friendly products

Changing incentives

E.g. subsidies for lower energy and resource intensive products

Banks and insurers charging a premium for unsustainable business practices

Fall in share price

As a result of reduced investor confidence following controversies

Loss of sales

E.g. customer boycott as a result of campaigning efforts

The company has the goal of doubling social capital impact over five years but no means of measuring progress.

Solution

GIST Impact prepares a series of annual Integrated Profit & Loss (IP&L™) Reports and benchmarks, KPIs, data frameworks and toolkits to measure and demonstrate successful delivery of the goal across multiple programmes.

Outcome

The company achieves its goal ahead of time and extends the programme through additional investments.

The company feared that its efforts to preserve nature were undervalued in a world focused on profit and loss.

Solution

GIST Impact measured the impact on environment and society of the company’s forestry operations and the offsetting benefits of preserving ecosystem services from owned forests.

Outcome

The company produces an Integrated Profit and Loss Report (IP&L™) that more than justifies its forest management policies by proving its contribution to GDP is more than twice its reported profits, and its ecosystem services are worth approximately USD 730 million and growing.

The company must demonstrate to stakeholders the expected return on additional investment in skills training.

Solution

GIST Impact values the human capital creation and positive human capital externality resulting from existing investments.

Outcome

The company justifies additional capital spending through a time series analysis, benchmarking to industry standards and a return-on-investment calculation.

The pension fund is committed to reporting its impact using the UN Sustainable Development Goals (SDGs), but needs a quantitative rather than qualitative assessment.

Solution

GIST Impact’s valuations provided through a distribution partner enable the pension fund to evaluate companies from the perspective of alignment with UN SDGs.

Outcome

The pension fund has the necessary financial scale to evaluate investments and move towards accurate SDG alignment at portfolio level.

The last few years have seen considerable harmonisation in the lexicon of measuring and quantifying impacts.

GIST Impact’s four capitals approach, definitions and methodology align with emerging industry standards, including the Capitals Coalition, the Value Balancing Alliance, and many others.

The quantified impacts measured across the four capitals can also be translated and redistributed to the Sustainable Development Goals (SDGs) via the GIST Impact SDG mapping methodology.

Aligned with global institutions

Consistent with key industry alliances

Mappable to reporting frameworks & guidelines

Regulatory requirements are mostly around consistent disclosure. Given that disclosure we calculate impacts and create benchmarks and time series.

ESG metrics rate companies on a variety of factors including how ambitious their targets are, how often they talk about sustainability, or how their greenhouse gas emissions compare to their competitors.

Impact metrics quantify companies’ real footprints on the environment and society, both positive and negative, planned and unplanned.

Impact starts where ESG metrics stop. For example, where ESG assesses a company’s water use, impact measurement translates this into the resulting change in availability of clean water and values the impact, such as the costs of more infectious diseases and malnutrition.

By quantifying impacts, business leaders understand what is important and material, which enables investments to be prioritised and risks to be mitigated.

Investment is all about risk and reward. ESG metrics are qualitative and can only be arbitrarily included in such an assessment, but impact metrics are calculated as monetary units and may be seamlessly integrated into earnings forecasts and financial valuations.

By tracking impacts as money, stakeholders have a simple means of comparing companies and measuring progress over time.

Understanding the full spectrum of corporate performance goes beyond financial statements. The “Integrated Profit & Loss Reporting” framework is designed to measure the impacts of business activities not just on…

We are delighted to announce that GIST Impact plays a prominent part in a new Microsoft white paper titled “Solving for Inclusive Economic Growth in the Era of AI”. Featuring…

We are proud to announce that GIST Impact has been profiled in an Environmental Finance article titled “Nature Data – overwhelmingly complex, but a need-to-know”. Offering insights from Pavan Sukhdev…

We were honoured to take part in a panel titled “From ESG & Sustainability to Impact: The Future of Finance” at Reset Connect, the signature event for London Climate Action Week. GIST…

GIST Impact is proud to have been featured in a report by Cape Capital, a Swiss wealth and investment management firm. Among Cape Capital’s offerings – across fixed-income, equity and…

It is our pleasure to announce the publication of a short article co-authored with TMX Datalinx, the Information Services division of TMX Group (the operator of multiple stock exchanges including…