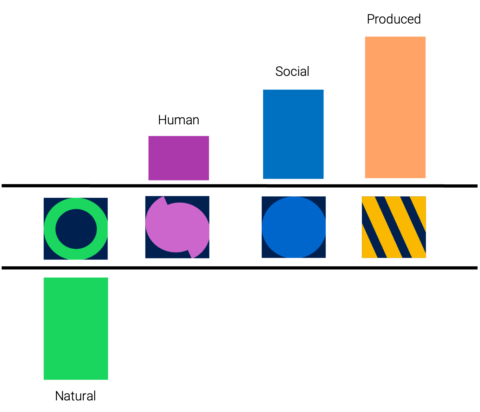

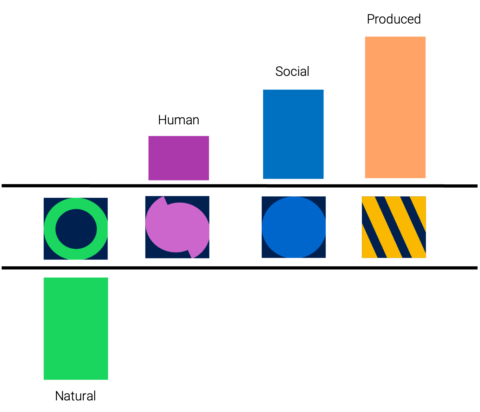

Integrated Profit and Loss Reporting

Understanding the full spectrum of corporate performance goes beyond financial statements. The “Integrated Profit & Loss Reporting” framework is designed to measure the impacts of business activities not just on…

This is the seventh post in our CSRD blog series – feel free to also check out:

CSRD preparations march on with recent clarifications from EFRAG. Companies are now moving fast to get ready for the requirements of the EU sustainability regulations expected in 2024. GIST Impact has the data and tools to streamline preparations, and in this blog post our regulatory expert Shraddha unpicks the nitty gritty of the ‘What, How, Who and When’ In the fast-evolving world of EU sustainability, staying updated on the latest developments is crucial, such as the European Union has introducing key enhancements related to EU Taxonomy, EFRAG presenting its work programme for 2024 to the Sustainability Reporting Board and the timings outline for upcoming deliverables and the Accounting Directive had been adjusted to encourage more meticulous sustainability reporting.

Here’s a brief overview of the latest developments:

1. Updates to the EU Taxonomy FAQs

To help companies align their sustainability reporting plans with the EU Taxonomy requirements, the European Commission has released a new, expanded FAQ that covers related questions on the EU Taxonomy Climate Delegated Act. The Act sets criteria for activities contributing to climate change mitigation and adaptation without harming other environmental objectives.

The Commission also released a separate FAQ focusing on the Disclosures Delegated Act under Article 8 of the EU Taxonomy Regulation, specifically related to reporting Taxonomy-eligible and Taxonomy-aligned activities and assets.

Alignment with the existing EU Taxonomy rules is mandated in both the upcoming Corporate Sustainability Reporting Directive (CSRD) as well as the current Sustainable Finance Disclosures Regulation (SFDR). Hence, any enhancements to the EU Taxonomy are intended to support these relevant regulations, and the latest FAQs aim to pre-empt any questions and/or confusion as CSRD takes effect.

2. Launch of Key European Sustainability Reporting Work Programmes for 2024

The European Financial Reporting Advisory Group (EFRAG) presented its work programme for 2024 to the Sustainability Reporting Board, outlining the timings for upcoming deliverables. EFRAG serves as the technical adviser to the European Commission and its task is to develop the draft European Sustainability Reporting Standards (ESRS) that will be used by all companies subject to the CSRD.

EFRAG’s Sustainability Reporting 2024 Work Programme includes updates on several key initiatives. These include:

The first set of twelve sector-agnostic ESRS, providing for proportionate but comprehensive reporting of environmental, social and governance matters, is now integrated in the European legal framework. This is a further milestone towards implementing a robust sustainability reporting framework in the European Union.

In addition, EFRAG has launched a Q&A platform to support reporting companies with the implementation of the ESRS. This platform will act as a centralised mechanism to address questions and provide feedback on technical issues from stakeholders. EFRAG will make he questions submitted and the answers provided public (all questions will be anonymised beforehand).

Separately, the European Commission published its 2024 Work Programme and Annexes, which include 18 policy initiatives and 26 proposals and initiatives to rationalise reporting requirements for businesses. The Commission has also submitted 15 proposals to support the rationalisation of reporting requirements adopted since March 2023 and 16 evaluation and fitness checks, indicating a comprehensive approach to streamline and evaluate policies, which can have implications for sustainability and efficiency.

Key developments included in the Work Programme, with potential implications for the 2024 sustainability agenda, include:

3. Adjustment to Accounting Directive for Inflation – Implications for Sustainability Reporting

The Accounting Directive, first published in 2013 forms the legal basis for single company and consolidated accounts within the European Union (EU). It establishes thresholds for defining companies as micro, small, medium, or large, with implications for accounting as well as sustainability reporting requirements.

In response to mounting inflation in the euro area, the Commission has proposed a notable adjustment to the Directive, suggesting a 25% increase in the size criteria for companies to counteract inflation. This will impact which companies are subject to certain financial and sustainability reporting requirements under the Accounting Directive and the EU Taxonomy Regulation, by essentially increasing the threshold of eligibility.

The changes are taking effect from January 1, 2024. However, these proposed amendments to the Accounting Directive require review by the Parliament and Council. If no objections arise, they will be formally published and implemented three days after the review process, starting from January 1, 2024.

This adjustment to the Accounting Directive underscores the European Commission’s dedication to adapting regulations amid an evolving economic landscape, ensuring that reporting requirements remain effective and efficient. Given these impending changes in sustainability standards, companies should consider conducting assessments to comprehend potential impacts and initiate preparations accordingly.

Conclusion

In conclusion, the recent EU sustainability developments are significant and have far-reaching implications for businesses when it comes to EU sustainability regulations. Understanding ‘What, How, Who and When’ is essential to ensure compliance and leverage the opportunities that these changes present. Companies should proactively assess the potential impacts of these updates for their businesses and prepare for the transition to the new standards. The European Commission’s Work Programme for 2024 emphasises streamlining reporting requirements to reduce administrative burdens and ensure a smooth transition for companies. These cumulative efforts will contribute to a more sustainable and efficient reporting landscape. The CSRD is still set to come into effect in 2024 as part of the EU sustainability regulations, with few delayed rules taking effect at a later date.

Stay tuned for more updates on EU sustainability regulations over the coming months.

If you’re interested in learning more about how GIST Impact can support your company’s CSRD-aligned double materiality assessment, get in touch with us at info@gistimpact.com.

Understanding the full spectrum of corporate performance goes beyond financial statements. The “Integrated Profit & Loss Reporting” framework is designed to measure the impacts of business activities not just on…

We are delighted to announce that GIST Impact plays a prominent part in a new Microsoft white paper titled “Solving for Inclusive Economic Growth in the Era of AI”. Featuring…

We are proud to announce that GIST Impact has been profiled in an Environmental Finance article titled “Nature Data – overwhelmingly complex, but a need-to-know”. Offering insights from Pavan Sukhdev…

We were honoured to take part in a panel titled “From ESG & Sustainability to Impact: The Future of Finance” at Reset Connect, the signature event for London Climate Action Week. GIST…

GIST Impact is proud to have been featured in a report by Cape Capital, a Swiss wealth and investment management firm. Among Cape Capital’s offerings – across fixed-income, equity and…

It is our pleasure to announce the publication of a short article co-authored with TMX Datalinx, the Information Services division of TMX Group (the operator of multiple stock exchanges including…