3 major benefits of streamlined CSRD preparations

Nearly 50,000 companies are preparing for the new CSRD regulations in the EU, a landmark that ushers in a new era for mandatory sustainability reporting.

GIST Impact offers a market-leading range of impact, biodiversity, and other sustainability data – enabling a unique, holistic, and rigorous assessment of value at granular resolution, worldwide.

With regulation and changes in the ESG market driving impact to the top of the global agenda, our data ensures that you stay ahead of the curve.

Science-backed, grounded in thousands of peer-reviewed research papers and robust economic modelling.

Intuitive, with impacts expressed in monetary terms and other tangible metrics – facilitating a standardised assessment of sustainability-related risks, and supported by an international scientific consensus.

Transparent, with full traceability to source documentation and clear methodologies behind calculation of derived data.

Mapped to the latest frameworks and regulations – including the CSRD, TNFD, SFDR, and UN SDGs.

Global yet local, with coverage across 14,500+ listed companies worldwide and operational impacts calculated at 50km2 granularity.

Augmented by best-in-class machine learning algorithms, enabling accurate estimations of sustainability data for both public and private companies – no matter the size.

Impact is the change in well-being across nature as well as society. GIST Impact measures changes in well-being in monetary terms across four ‘capitals’: Natural, Human, Social, and Produced.

Monetary impact valuation speaks the language of traditional financial analysis – facilitating a standardised assessment of sustainability performance, and ensuring comparability across sectors and regions.

Download impact data for 50 of the largest companies

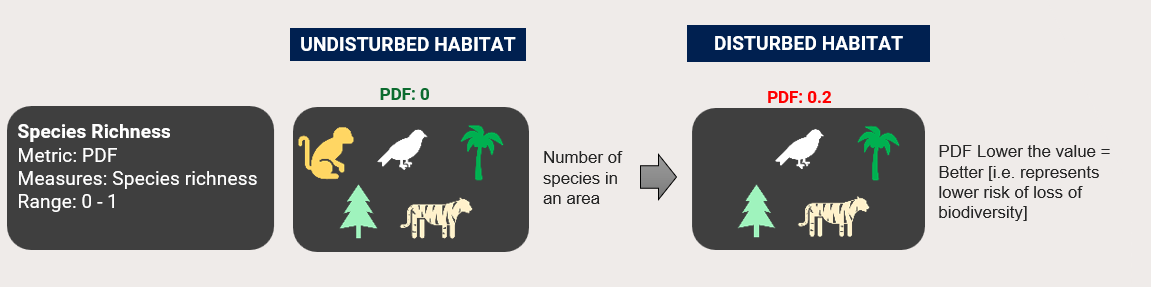

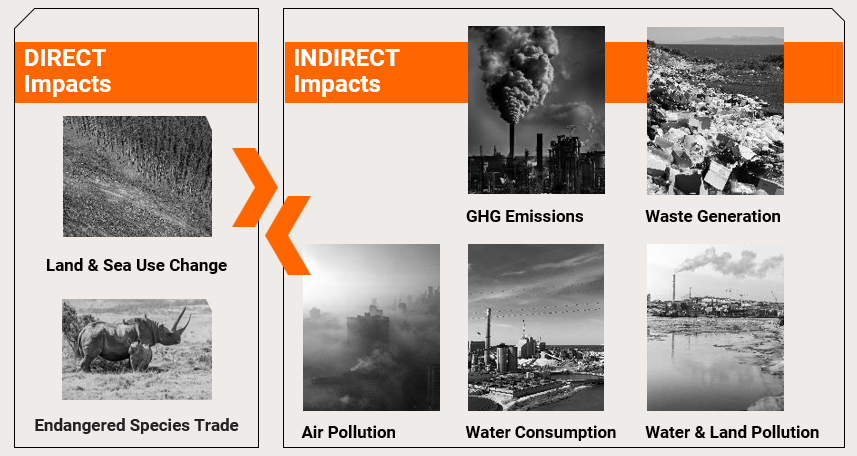

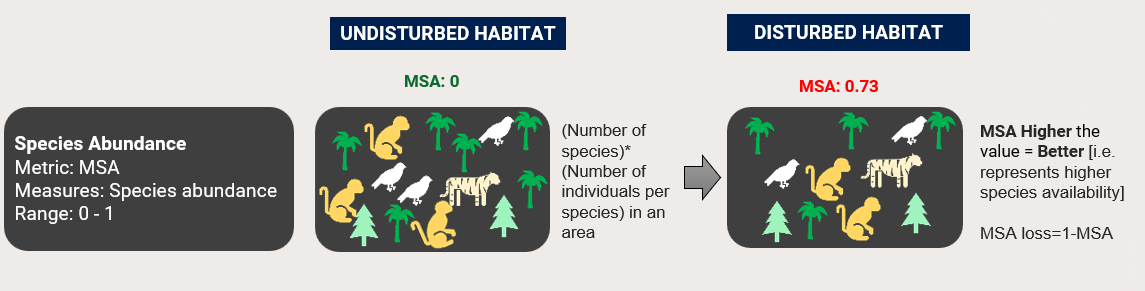

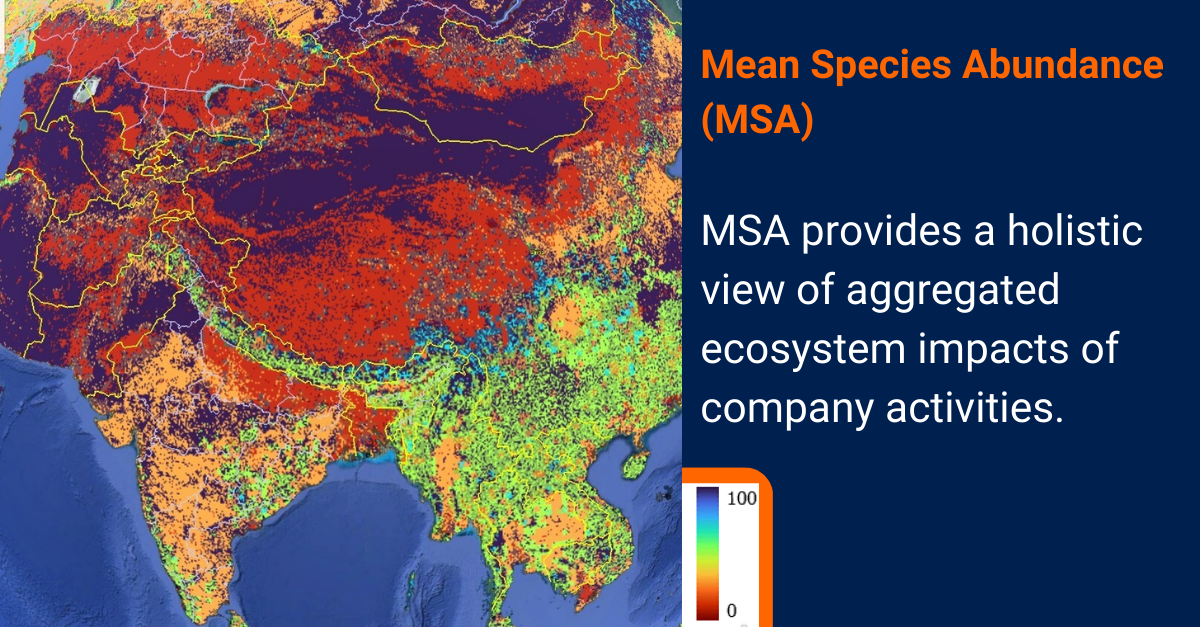

Biodiversity is the foundation of resilient and sustainable economies – with companies and investors facing increasingly urgent demand to innovate while reducing their footprints on nature. GIST Impact measures nature-related impacts and dependencies in both monetary terms and using universally-accepted, science-backed metrics.

With over 16 years of expertise in biodiversity and in partnership with leading organisations, GIST Impact offers an unparalleled dataset for measuring nature-related risks and opportunities anywhere in the world.

From 2024, the Corporate Sustainability Reporting Directive (CSRD) puts a substantial reporting burden on up to 50,000 companies operating in the European Union – mandating a rigorous assessment of Impacts, Risks, and Opportunities (IROs) across company operations.

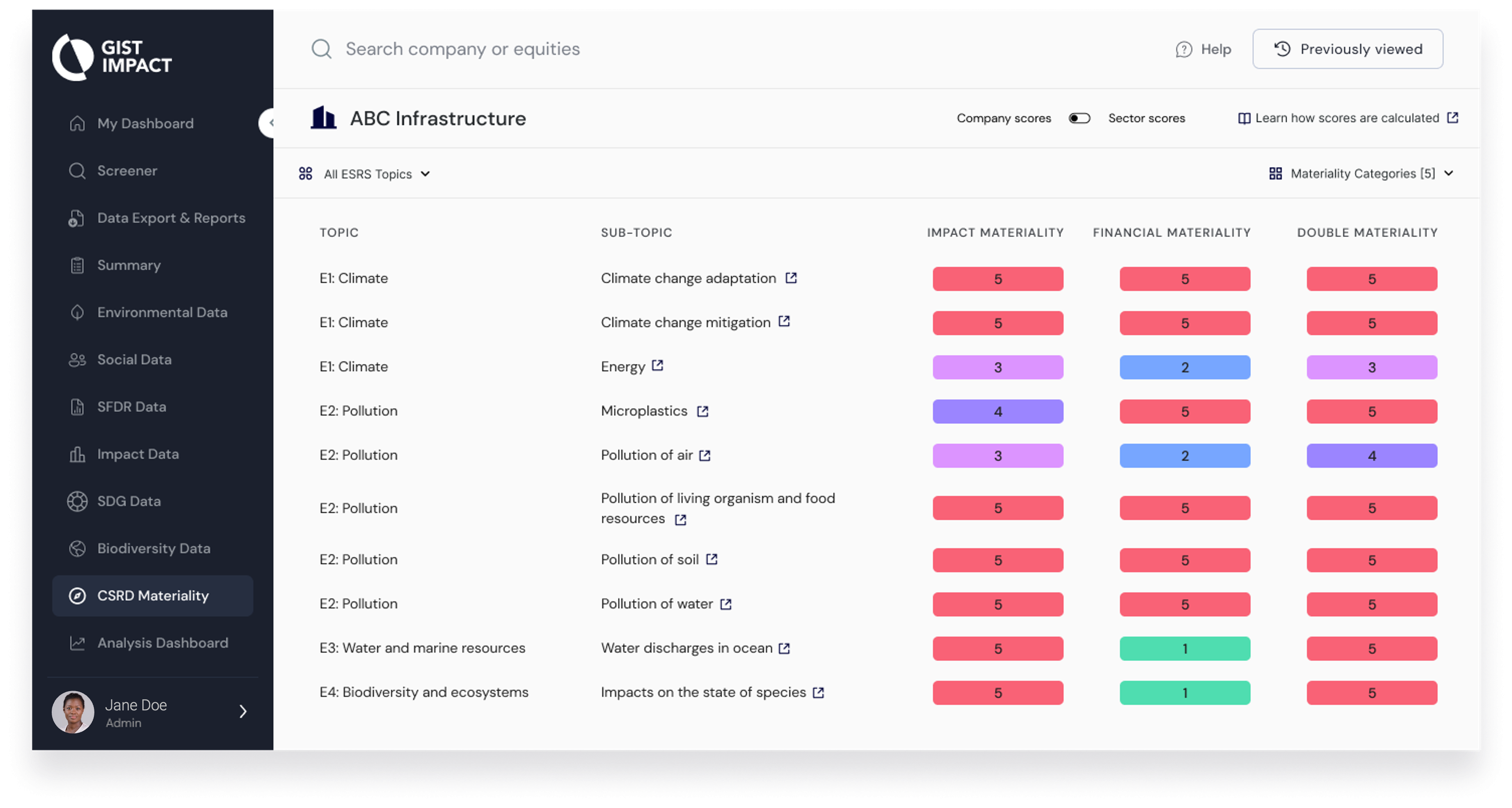

GIST Impact offers a state-of-the-art, data-driven approach to conducting a quantitative double materiality assessment in line with the latest CSRD requirements and European Sustainability Reporting Standards (ESRS).

With 1,102 datapoints for each company to consider each year, the GIST Impact Double Materiality Scores provide a significant advantage to those undertaking the CSRD reporting and analysis journey – supporting rapid gap analysis and resolution with market-leading estimation models where data is unavailable.

Challenges:

Set in 2016, the United Nations Sustainable Development Goals (UN SDGs) have become the global polestar for guiding action on the most pressing challenges and opportunities facing humankind.

GIST Impact quantifies and allocates company impacts across the SDGs in monetary terms.

As a global leader in measuring and quantifying company impacts, GIST Impact offers an unmatched, science-backed dataset that offers granular insight into the UN SDGs.

Challenges:

The environment is the bedrock of our well-being – and society is the structure that preserves it. GIST Impact offers a comprehensive set of quantitative environmental and social data – across hard-to-find metrics, and with all disclosure gaps filled.

As a pioneer of science-driven, institutionally-backed research for 16+ years, GIST Impact has emerged as a trusted source for clear and actionable sustainability data that matters.

Download sustainability raw data (disclosed & modelled) for 50 of the largest companies

Diversity, Equity and Inclusion is the cornerstone of good governance and drives organisation performance.

GIST Impact offers a wide-ranging dataset that reveals DEI performance at multiple levels of granularity.

Quantitative data ensures actionable insights into DEI performance and enables guided strategic and operational planning.

Use GIST Impact’s impact valuation APIs to produce your own impact reports.

Use GIST Impact’s newly introduced platform for investors and corporates.

Our impact data is used by some of the world’s largest pension funds and sovereign wealth funds, and forward-thinking asset managers and wealth managers, with over $4.5 trillion in assets under management.

Nearly 50,000 companies are preparing for the new CSRD regulations in the EU, a landmark that ushers in a new era for mandatory sustainability reporting.

Our businesses. Our economies. All of our livelihoods depend on nature. But nature is declining globally at rates unprecedented in human history. This December, governments, civil society, businesses and financial…

GIST Impact is proud to announce that it has been named ESG Data Provider of the Year – EMEA in the Environmental Finance Sustainable Investment Awards 2024. The Sustainable Investment…

Zurich, 20 June 2024 – Today GIST Impact, the leading provider of impact data and analytics, announced an investment from UBS Next, the leading universal Swiss bank’s venture and innovation…

Exciting News! GIST Impact, a leading provider of impact data and analytics, is thrilled to announce a strategic partnership with S7, an Oslo-based advisory firm that helps leaders drive transformation…

London, 12 June 2024 – Leading impact data and analytics provider GIST Impact today announced the strengthening of its leadership team with the appointment of Vineet Gupta as Senior Vice…

GIST Impact was delighted to contribute to the “Impact Valuation Sprint Report,” coordinated by the Value Balancing Alliance and launched in May 2024.

On our latest webinar, GIST Impact CEO Pavan Sukhdev and Global Partner Rayne van den Berg discussed the topic of “Nature’s Value: Integrating Biodiversity Data for Effective Investment Strategies”. With the global shift…